- europages

- >

- COMPANIES - SUPPLIERS - SERVICE PROVIDERS

- >

- accounting and auditing

Results for

Accounting and auditing - Import export

TEVOLUTION LTD

United Kingdom

One Stop Shop Service: Bring Your Stock Closer to Your UK Customers! Streamline your business operations with our comprehensive all-in-one service. From tax representation, customs clearance, customs compliance, product compliance, to VAT reporting – we've got you covered! Why Choose Us? Simple Goods Management Cycle: Pay taxes and duties seamlessly at every point Flexibility: Easily move goods to any required process. Remission Advantage: Apply for remission if goods are returned within three years of export. Achieve faster deliveries and increased customer satisfaction by having stock readily available in the UK. Choose efficiency. Choose our one-stop-shop service.

Request for a quote

B&SI SERVICE LTD

Bulgaria

Organisation of the company accounting form and elaboration of the company policy; Preparation and update of an own chart of accounts; Setting up individual detailed accounts; Processing of primary accounting documents, income documents, receipts, bank documents, etc.; Preparation and keeping accounting registers; Accounting for fixed tangible and intangible assets; Elaboration of an accounting and tax depreciation schedule and accounting of fixed asset depreciation; Accounting for company stock; Calculation of item and service cost; Preparation and submission of monthly logs and statement-declarations under the VAT Act and VIES; Submission of information related to the Intrastat system; Accounting for and analysis of accounts with contractors, suppliers and clients; Current regular reports and analyses in relation to the accounts with suppliers and clients, warehouses and cash flows, income, expense and other indicators, for your needs as a company manager.

Request for a quote

B&SI SERVICE LTD

Bulgaria

For you, in the end of each accounting year, we at B&Si Service: will make up an individual (consolidated if needed) Annual financial report based on NFRSSME and IFRS for the Commercial register at the Registry Agency and for the management needs; will fill out and submit the annual tax returns as per the Act on Taxation of the Income of Natural Persons /ATINP/ and the Corporate Income Taxation Act /CITA/; will fill out and submit the necessary annual statistical forms to the National Statistics Institute.

Request for a quote

B&SI SERVICE LTD

Bulgaria

Organising and maintaining files of the company employees; Execution and registration of labour contracts, additional agreements and employment contract termination orders with the National Revenue Agency; Execution of civil contracts, receipts for paid sums and certificates; Preparation and submission of patient’s charts and declarations for compensations by the State Social Security, calculation of leaves; Execution of pay-rolls, pay-slips and recapitulations; Issuance, in favour of the employees, of annual income certificates and other certificates related to any labour remuneration received or documents required for retirement. Filling out labour insurance books and certification of insured experience; Submission of information about insured persons to the personal register at the National Insurance Institute; Filing out all the necessary orders for payments to the budget related to the due tax and social insurance contributions.

Request for a quote

JMC ACCOUNTANTS & TAX ADVISERS LTD

United Kingdom

Our bookkeping services help clients around the UK with their VAT returns and record keeping. We help business owners by reliving the stress and burden of their regular financial duties by providing high-quality bookkeping services. We can help generate your VAT returns in a digital manor, ready for submission, or simply add the finishing touches to your own work. We also help keep businesses records tidy and in order, which decreases the time it takes for any addition work we provide. And will also insure you know exactly where you stand with your finances.

Request for a quote

TAX NAVIGATOR

United Kingdom

We specialise in handling all of your accounting paperwork and track all of your day-to-day financial transactions. We help sole proprietors, partnerships and limited companies anywhere in the UK. With our excellent service, you can forget about costly errors in the bookkeeping process. Moreover, we invest our time and effort in preparing your annual accounts and business reports as part of our bookkeeping package. Don't miss to contact us for a free, yet priceless, quote.

Request for a quote

TAX NAVIGATOR

United Kingdom

We handle the whole chain of services for VAT returns: registration and communication with HMRC, calculation, input and output data, and even deregistration. Moreover, we advice our clients on the best VAT scheme for their business and make sure they get the maximum value added tax return specified by the accounting legislation. In addition, we focus on quality communication with our clients, making sure their best interests are taken care of. Integrity, dedication, and loyalty are key components of our work ethics.

Request for a quote

TAX NAVIGATOR

United Kingdom

We are specialised in all aspects of your employees’ income and tax deduction admin operations. You can rest assured your PAYE compliance will be handled with all due diligence and we leave no paycheck behind. As the payroll service provider for all kinds of UK-based small businesses, we know exactly what your particular kind of company needs. We keep up to date with the payroll legislation and our service provides all the required professional help for your financial responsibilities.

Request for a quote

PROPERSOFT

Canada

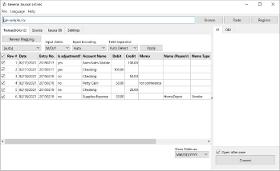

Create General Journal Entries quickly in Excel or another spreadsheet software and convert to IIF or QBJ files ready to import into QuickBooks. Use predefined spreadsheet template to quickly fill debit and credit lines for one or more entries or export from your production system and convert to a format compatible with QuickBooks.

Request for a quote

PROPERSOFT

Canada

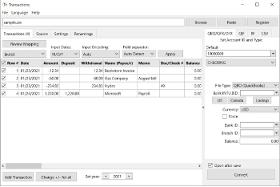

Need to import bank or credit card transactions in a CSV/XLS/XLSX/TXT, PDF, QFX, OFX, QBO, QIF/QMTF, MT940/STA file into your accounting or personal finance software but cannot seem to make it work? The Solution: try the Transactions app. It can convert your transactions into a format that your accounting/personal finance software can import. The Transactions app converts your bank and credit card transactions files into a file format compatible with your accounting or personal finance software like QuickBooks (Desktop or Online), Quicken, Xero, Sage, Wave, FreeAgent, Banktivity, Kashoo, ZARMoney, Excel and many others importing standard financial file formats like OFX, QBO, QFX, QIF, IIF, CSV.

Request for a quote

ANDREW PASSER ACCOUNTANT

United Kingdom

Andrew Passer accountant specialising in property tax and accounting for landlords and property investors. Get the best expert advice and guidance for your needs. I have 40 years years of experience in property taxation I am well-equipped to handle all your tax and advisory matters. I will advise you on the most tax-efficient strategies and ensure that your documents are completed and returned correctly. Whether you are a first-time landlord, have a holiday-let or multiple tenanted properties, I can assist you with all your property tax related needs, from tax planning and advice to the preparation and submission of tax returns. Services include; Property tax planning and advice Preparation and submission of tax returns Property tax reliefs and exemptions Advice on capital gains tax Advice on stamp duty land tax for property purchases Advice on inheritance tax for property owners

Request for a quote

ANDREW PASSER ACCOUNTANT

United Kingdom

Andrew Passer accountant for small business - accounting and tax advisory services to clients in London and Greater London areas. Managing your business tax, accounting, bookkeeping and payroll. A full range of accountancy services, including financial statement preparation, tax planning and compliance, and advisory services for small businesses. With personalised proactive advice I am committed to providing exceptional service and making your business tax efficient.

Request for a quote

DOUGLAS HOME & CO

United Kingdom

Douglas Home and Co offer bookkeeping and VAT services to individuals and companies

Request for a quote

BECOMPLIANT

France

Find out if you are required to register, and what are the conditions in Spain. Spanish VAT rates, Intrastat compliance and more.

Request for a quote

4WARD MERCHANT SERVICES

United States

I am working on being the best Merchant Service provider with not only selling one product but selling and integrating into almost any product you want to work with so I can help your business be more efficient. For the B2B clients we offer certain software's the automatically fill out the annoying information like Address, Zip Code, City etc. Check out the website on the B2B page to see what software we commonly use and please let me know if you are interested in seeing anything certain or if you want to work with your current software but might need to revisit your processing rates.

Request for a quote

WHIN GLOBAL

United States

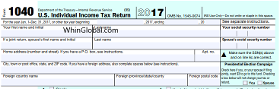

US Tax Services provided your way. Income Tax Preparation & Planning Services for individuals, small private companies, high net worth individuals, US expats, American taxpayers living abroad or in the US, and global employers with global mobility tax needs

Request for a quote

WILLIAMSONS CONSULTANTS LTD

United Kingdom

Preparation of Statutory accounts for Sole Traders, Partnerships and Limited Companies.

Request for a quoteDo you sell or make similar products?

Sign up to europages and have your products listed

TEZCONSA ASESORES

Spain

La correcta elaboración de la contabilidad nos permitirá tener en todo momento un diagnóstico real de la situación económico financiera de su empresa, lo que a su vez permitirá elaborar planes financieros, fiscales y de carácter general para el crecimiento de su empresa.

Request for a quote

GLOBAL CONSULT BALCAN LTD

Bulgaria

Accounting services in Bulgaria. Company incorporation in Bulgaria.

Request for a quote

ZEE TECH SUPPORT

Australia

At Zee Tech Support, we are committed to providing high-quality virtual assistance services that help businesses and individuals achieve their goals. We are dedicated to delivering excellence in everything we do, and we look forward to working with you. Contact us today to learn more about our virtual assistance services and how we can help you achieve your business goals.

Request for a quoteResults for

Accounting and auditing - Import exportNumber of results

21 ProductsCountries

Company type