- europages

- >

- COMPANIES - SUPPLIERS - SERVICE PROVIDERS

- >

- accountant

Results for

Accountant - Import export

SHERWIN CURRID ACCOUNTANCY

United Kingdom

If you’re thinking about working for yourself, setting up as a sole trader is the easiest way to get started. To help you make the jump from employment to being your own boss, we can advise on: Tax and National Insurance implications of being a sole trader Registering for self-assessment, and completing and filing your annual returns Practical and legal aspects of VAT, registration and accounting systems Business insurance Operating as a sole trader, versus other business structure options We offer a range of specialist financial advice for contractors and freelancers through our dedicated division SC Plus.

Request for a quote

B&SI SERVICE LTD

Bulgaria

For you, in the end of each accounting year, we at B&Si Service: will make up an individual (consolidated if needed) Annual financial report based on NFRSSME and IFRS for the Commercial register at the Registry Agency and for the management needs; will fill out and submit the annual tax returns as per the Act on Taxation of the Income of Natural Persons /ATINP/ and the Corporate Income Taxation Act /CITA/; will fill out and submit the necessary annual statistical forms to the National Statistics Institute.

Request for a quote

B&SI SERVICE LTD

Bulgaria

Apart from the base services listed herein, at our office we can also do the following for you: presenting payment orders and pay-in slips at your servicing bank branch; receiving your bank statements; filling out any bank documents not related to any tax and social insurance liabilities; performing on-line banking; submitting a request and obtain a certificate of the availability or lack of any liabilities; submitting a request and obtain a good standing certificate of the company; publishing the Annual financial report at the Commercial register; filling out any documents for crediting and financing by bank institutions; making up any agreements, annexes and agreement memoranda with your partners; preparing any other statements and reports required by the company management

Request for a quote

B&SI SERVICE LTD

Bulgaria

Organisation of the company accounting form and elaboration of the company policy; Preparation and update of an own chart of accounts; Setting up individual detailed accounts; Processing of primary accounting documents, income documents, receipts, bank documents, etc.; Preparation and keeping accounting registers; Accounting for fixed tangible and intangible assets; Elaboration of an accounting and tax depreciation schedule and accounting of fixed asset depreciation; Accounting for company stock; Calculation of item and service cost; Preparation and submission of monthly logs and statement-declarations under the VAT Act and VIES; Submission of information related to the Intrastat system; Accounting for and analysis of accounts with contractors, suppliers and clients; Current regular reports and analyses in relation to the accounts with suppliers and clients, warehouses and cash flows, income, expense and other indicators, for your needs as a company manager.

Request for a quote

JMC ACCOUNTANTS & TAX ADVISERS LTD

United Kingdom

Helping individuals build their own business, from incorporating their business, to handling the legal and financial responsibilities of its operations. We help individuals across the West Midlands & UK by helping them decide on the most suitable structure for their business, prepare cashflows and business plans, and even deal with any secretarial issues. Our team will also provide you with a dedicated accountant, whom will set you up on our digital system that will keep track of your records such as invoices and payments, and enable us to file your returns when the time comes.

Request for a quote

JMC ACCOUNTANTS & TAX ADVISERS LTD

United Kingdom

Our bookkeping services help clients around the UK with their VAT returns and record keeping. We help business owners by reliving the stress and burden of their regular financial duties by providing high-quality bookkeping services. We can help generate your VAT returns in a digital manor, ready for submission, or simply add the finishing touches to your own work. We also help keep businesses records tidy and in order, which decreases the time it takes for any addition work we provide. And will also insure you know exactly where you stand with your finances.

Request for a quote

WILLIAMSONS CONSULTANTS LTD

United Kingdom

Preparation of Statutory accounts for Sole Traders, Partnerships and Limited Companies.

Request for a quote

GLOBAL CONSULT BALCAN LTD

Bulgaria

Accounting services in Bulgaria. Company incorporation in Bulgaria.

Request for a quote

LICHARZ GMBH

Germany

See stored personal data Change E-Mail or password Change newsletter subscription

Request for a quote

TEVOLUTION LTD

United Kingdom

One Stop Shop Service: Bring Your Stock Closer to Your UK Customers! Streamline your business operations with our comprehensive all-in-one service. From tax representation, customs clearance, customs compliance, product compliance, to VAT reporting – we've got you covered! Why Choose Us? Simple Goods Management Cycle: Pay taxes and duties seamlessly at every point Flexibility: Easily move goods to any required process. Remission Advantage: Apply for remission if goods are returned within three years of export. Achieve faster deliveries and increased customer satisfaction by having stock readily available in the UK. Choose efficiency. Choose our one-stop-shop service.

Request for a quote

TEVOLUTION LTD

United Kingdom

As of 1st October 2023, the European Union mandates that businesses from third countries exporting select products, including Hydrogen, Cement, Urea, Ammonia, Fertilizers, Iron, Steel, and Aluminum, provide comprehensive carbon footprint data. With Tevolution Ltd's expert services, seamlessly navigate this intricate mandate and stay compliant. Understand the nuances of the new EU regulations. Navigate the boundaries set by the EU with clarity and confidence. Comprehensive assessment to ensure your data's accuracy and compliance. Detailed classification code reviews for each product. Thorough examination of your business processes. Align your methods to the EU's stringent standards. Ensure complete compliance, reducing risks of non-adherence penalties. Achieve peace of mind with expert-backed data accuracy. Stay ahead in the market by showcasing commitment to sustainability and transparency.

Request for a quote

«O2 CONSULTING» LLC

Russia

O2 Consulting provides fully-fledged accounting services to its clients: Overall financial accounting and tax accounting for Russian companies, preparing and submitting reports Ongoing advice on the RAS financial and tax accounting methodology and reporting Advice on application of the IFRS

Request for a quote

CALLBOX INC.

United States

Generate more leads and close deals faster with Callbox ABM lead generation services! Callbox offers a multi-touch ABM solution that combines inbound and outbound channels to support the different stages of your ABM program. To learn more about our Account-based Marketing Services, visit Callbox today.

Request for a quote

GOLCOM D.O.O.

Slovenia

In an increasingly competitive business environment, experienced advisory services are becoming more important than ever. We offer a comprehensive and tailor-made solution that fills the need of a novice entrepreneur, just starting on their business path, as well as the need of one who has been active in the market for a while and knows exactly what they need to make their operations even more successful. Main accounts and ancillary accounting, Accounting for remuneration (salaries, fees, royalties, rent), Accounting for VAT, Preparing annual accounts and financial statements, Preparing mandatory reports, Accounting advisory services (tax optimisation), Preparing bespoke reports for management and owners, Advising the custodian, Support in submitting bank forms,

Request for a quote

AAAGILER GMBH, INDUSTRIAL WHOLESALER AND PURCHASING AGENT FOR INDUSTRIAL SUPPLIES

Germany

Agile outsourced CFO services for international companies and startups in Germany.

Request for a quote

HB PUBLICATIONS AND TRAINING INTERNATIONAL

United Kingdom

Description This book is one of a series of books entitled Essential Skills for the Public Sector. It is increasingly important for public sector managers to have an understanding of finance to perform their jobs and deliver value for money services. It explains the principles of finance as well as financial information such as income and expenditure accounts, balance sheets, cashflows and financial performance indicators. There are worked examples and practical exercises which allow the theory to be put into practice, encouraging self-development and continuous improvement. The style is simple, easy to read, and accessible to staff at all levels within an organisation. It is an essential addition to a manager’s toolkit of skills and knowledge. Size: 150 mm by 210 mm 134 Pages ISBN : 978 1899448 678

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

If you’re going into business for the first time, buying a franchise has many benefits: a proven product and business model, a defined territory, marketing and promotional support – but it can still be a daunting prospect. At Sherwin Currid, we’ve helped clients acquire franchises in numerous different sectors and can offer you the long-term, individual support you need. We can: Review your franchise agreement Advise on company formation, VAT returns and franchisor reports Help you set up your accounts, payroll, and franchisor reporting in the required format Offer you peace of mind through fixed fees and guaranteed turnaround times

Request for a quoteDo you sell or make similar products?

Sign up to europages and have your products listed

SHERWIN CURRID ACCOUNTANCY

United Kingdom

Managing your property rental can be a job in itself, so we aim to keep your accounting and tax duties as simple as possible. Whether you have a holiday let or a portfolio of tenanted properties, we can assist you with compliance. And if you plan to sell your investment property, we will be able to advise you on the capital gains tax considerations. We can recommend independent financial advisers, authorised and regulated by the Financial Conduct Authority, who will be able to help you secure a mortgage and inheritance tax planning. You can request a call back here.

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

If you have a business idea, but need advice on starting up, we can help. Besides accounting and tax compliance, we can give you guidance on business essentials such as Setting up a business bank account and arranging insurance Limited company formation versus sole trader Cloud accounting software and bookkeeping Connected apps for cashflow forecasting and industry-specific needs such as inventory Applying for investment schemes such as SEIS and EIS We offer a range of specialist financial advice for contractors and freelancers through our dedicated division SC Plus.

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

Administering your payroll takes up time, energy and resources you need for your main business activities. It’s also becoming an increasingly complex task, with potentially heavy penalties if you’re not fully compliant. Add subcontractors to the mix, and the administrative headaches only increases – especially if you’re covered by the Construction Industry Scheme (CIS). Under CIS, you’re responsible for reporting your subcontractors’ payments and tax deductions to HMRC every month, with big fines possible if you make a mistake. We’re here to help with all aspects of your payroll and CIS obligations, including: Managing PAYE, NI, Statutory Sick Pay, Statutory Maternity Pay and other taxes and benefits Completing statutory monthly and annual returns to HMRC Setting up and running automatic enrolment pension schemes Preparing and submitting your subcontractor monthly returns on time Administering the subcontractor verification process

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

Working for yourself means taking charge of your own tax affairs, which can be intimidating if you’ve got used to your employer looking after them for you. We can offer practical help and advice on all aspects of personal tax, ensuring you comply with HMRC rules, and make all your returns and payments on time. We offer a range of specialist financial advice for contractors and freelancers through our dedicated division SC Plus. At Sherwin Currid, we also have particular expertise in tax for non-UK residents, and cross-border tax arrangements for expat individuals and businesses.

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

Forming a company brings many benefits, not least limiting your personal liability for any losses. But it also means complying with company law, bringing new complexity into your management processes. As specialists in accounting for small and medium-sized businesses, Sherwin Currid can advise and assist with all aspects of setting up and running your limited company, including: Company formation and registration with Companies House Running a payroll Setting up an appropriate VAT scheme Shareholdings, dividends and tax Completing and filing your statutory returns on time Incorporating an existing sole trader business

Request for a quote

NOORD CONNECT LLC

Russia

We offer consulting services in logistics, organization of cargo transportation and implementation of project deliveries. Our more than twenty years of experience in this field helps clients to introduce significant cost savings and find unconventional solutions to problems related to the procurement, transportation, certification, customs clearance and distribution of goods.

Request for a quote

B&SI SERVICE LTD

Bulgaria

Organising and maintaining files of the company employees; Execution and registration of labour contracts, additional agreements and employment contract termination orders with the National Revenue Agency; Execution of civil contracts, receipts for paid sums and certificates; Preparation and submission of patient’s charts and declarations for compensations by the State Social Security, calculation of leaves; Execution of pay-rolls, pay-slips and recapitulations; Issuance, in favour of the employees, of annual income certificates and other certificates related to any labour remuneration received or documents required for retirement. Filling out labour insurance books and certification of insured experience; Submission of information about insured persons to the personal register at the National Insurance Institute; Filing out all the necessary orders for payments to the budget related to the due tax and social insurance contributions.

Request for a quote

BESTON MACHINERY

China

Are you in the market for an egg tray machine? Perhaps you're contemplating the intricacies of investing in an egg tray making machine. Navigating the world of these machines and differentiating between high-quality models and the rest can be a challenge. In this guide, we'll assist you in understanding how to approach the selection process for the right tray making machine. Two vital factors must be at the forefront of your decision-making: the manufacturer and the machine itself. Let's delve into the manufacturer aspect first. The Manufacturer's Reputation: A Key Determinant A manufacturer's reputation is a cornerstone in this equation. It's synonymous with the quality of their products. Research their reputation by inquiring about their standing in the industry. After all, an egg tray machine involves a substantial investment.

Request for a quote

TAX NAVIGATOR

United Kingdom

We are specialised in all aspects of your employees’ income and tax deduction admin operations. You can rest assured your PAYE compliance will be handled with all due diligence and we leave no paycheck behind. As the payroll service provider for all kinds of UK-based small businesses, we know exactly what your particular kind of company needs. We keep up to date with the payroll legislation and our service provides all the required professional help for your financial responsibilities.

Request for a quote

TAX NAVIGATOR

United Kingdom

We specialise in handling all of your accounting paperwork and track all of your day-to-day financial transactions. We help sole proprietors, partnerships and limited companies anywhere in the UK. With our excellent service, you can forget about costly errors in the bookkeeping process. Moreover, we invest our time and effort in preparing your annual accounts and business reports as part of our bookkeeping package. Don't miss to contact us for a free, yet priceless, quote.

Request for a quote

TAX NAVIGATOR

United Kingdom

We handle the whole chain of services for VAT returns: registration and communication with HMRC, calculation, input and output data, and even deregistration. Moreover, we advice our clients on the best VAT scheme for their business and make sure they get the maximum value added tax return specified by the accounting legislation. In addition, we focus on quality communication with our clients, making sure their best interests are taken care of. Integrity, dedication, and loyalty are key components of our work ethics.

Request for a quote

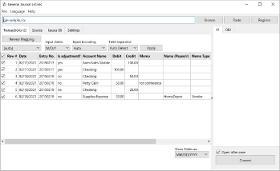

PROPERSOFT

Canada

Create General Journal Entries quickly in Excel or another spreadsheet software and convert to IIF or QBJ files ready to import into QuickBooks. Use predefined spreadsheet template to quickly fill debit and credit lines for one or more entries or export from your production system and convert to a format compatible with QuickBooks.

Request for a quoteResults for

Accountant - Import exportNumber of results

48 ProductsCountries

Company type

Category

- Accounting and auditing (23)

- Business Consultancy (7)

- Software - business management (4)

- Consultants, financial analysis (3)

- Outsourcing of financial services and administration (2)

- Software (2)

- Administrative assistant (1)

- Auditing, international (1)

- Banking services (1)

- E-business - services (1)

- Electronic books (1)

- Goods transport (1)

- Grains, livestock and poultry (1)

- Hosting of online services (1)

- Marketing (1)

- Online marketing (1)

- Road transport - logistical services (1)

- Secure payment - software and systems (1)