Unveiling Growth and Opportunities: ep Q4 2023 Barometer Analysis Sparks Optimism for 2024

In the ever-evolving landscape of business, staying informed about market trends and shifts is paramount. The ep Q4 2023 Barometer Analysis explores the Eurozone's B2B markets, giving insights into upcoming changes and opportunities. It also looks at trends among professional buyers and developments in the sourcing market. Armed with these insights, SMEs will be well-prepared to navigate the challenges and seize the opportunities that 2024 may bring.

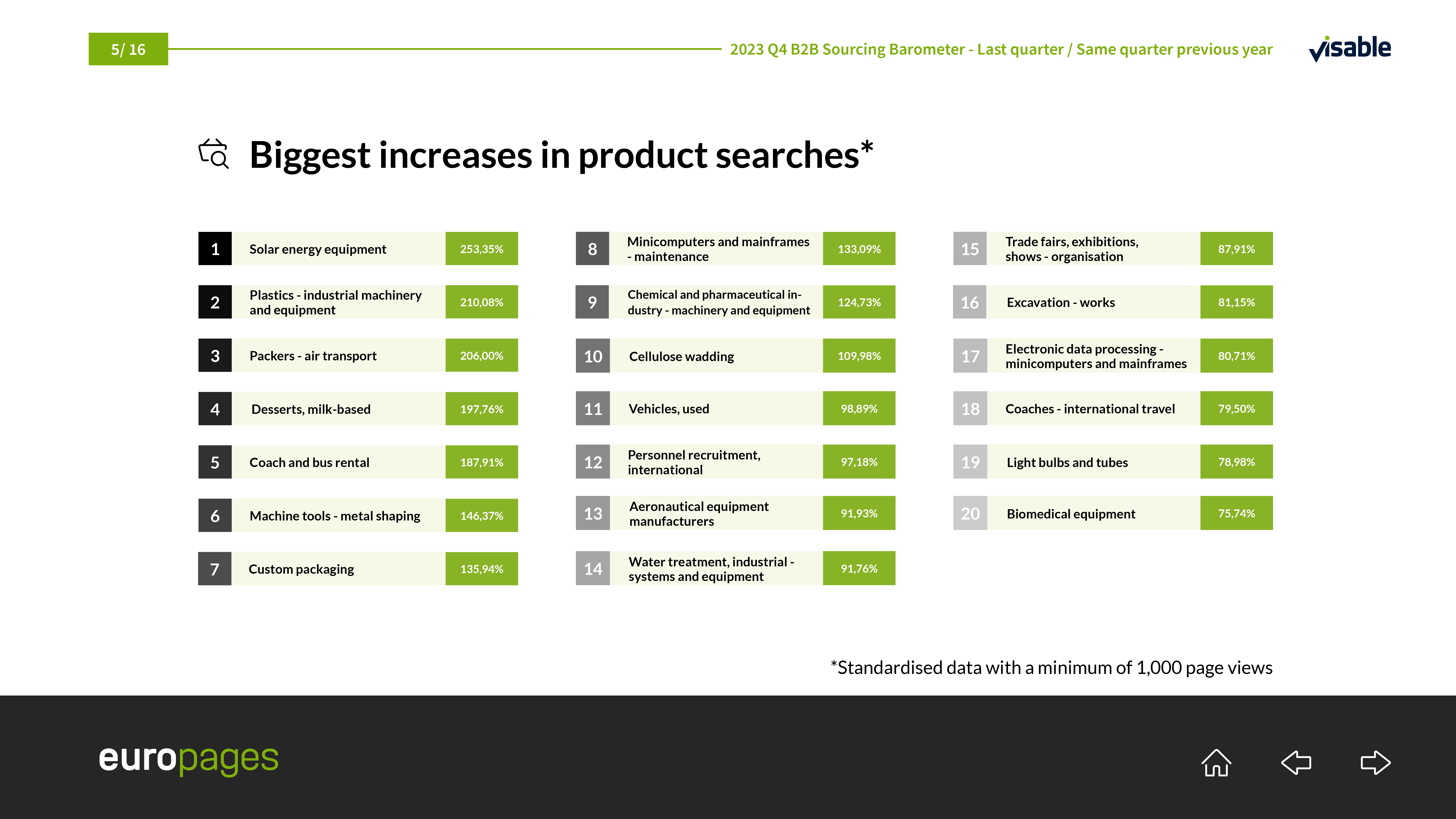

Surge in Solar Energy Equipment Searches

The standout revelation from the analysis is the staggering 253.35% surge in searches for solar energy equipment compared to the previous year's Q4. This unprecedented increase is driven by the imminent expiration of the electricity tariff shield in 2025, coupled with a significant rise in electricity prices across Europe. The root cause lies in the reduced supply of Russian gas, resulting in notable electricity cost spikes:

- 4-5% in Germany, Austria, and Poland.

- 9% in France.

- A staggering 70% in Denmark.

Shifts in Product Searches

Q4 witnessed a vibrant shake-up in the product search landscape, unveiling an entirely new top 20 that differs significantly from the Q3 lineup. Transport rail emerged as the frontrunner, claiming the coveted 1st place. This surge aligns seamlessly with the eco-planning and infrastructure preparations for the upcoming 2024 Olympic and Paralympic Games in France.

The top 20 list reflects a diverse mix of sought-after items, ranging from explosive fireworks to luxurious foie gras, delightful dairy desserts, warm chestnuts, convenient frozen prepared meals, and hotels and restaurants. The surge in these searches can be attributed to heightened preparations for year-end festivities, like a product search party gearing up for a year-end celebration extravaganza!

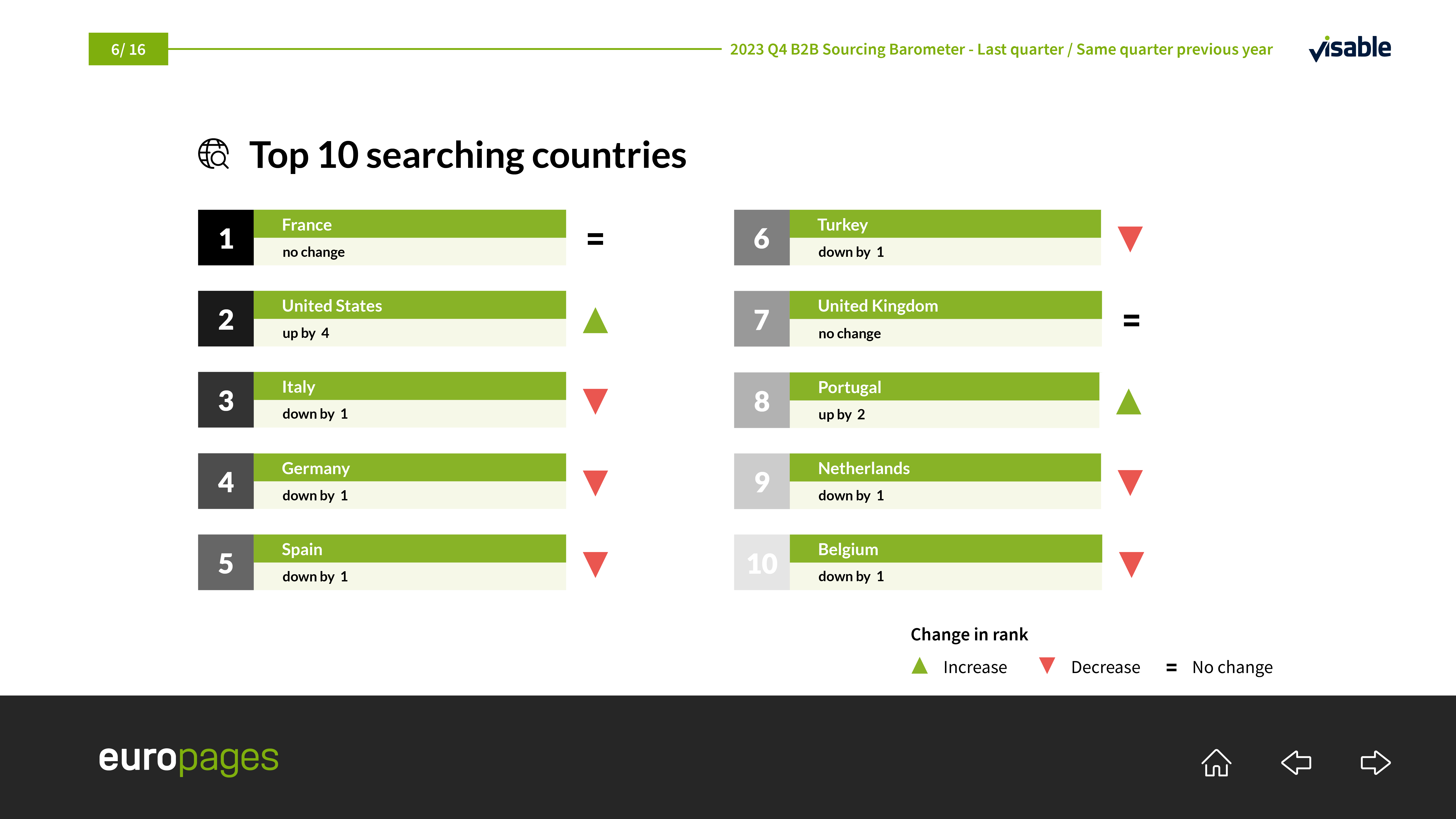

France leading the way in Q4 and Year-to-Year

In both the quarterly analysis for Q4 and the year-to-year assessment, France retains its top-ranking position as the country with the most substantial volume of product searches. Not only does it maintain this leading role, but it also secures the top spot among nations both initiating and receiving pertinent direct requests. This underscores France's prominent role in the dynamic landscape of product searches and market interactions.

Germany remains at the top of the most searched countries, Year to year and in Q4, followed by the US who gained ground holding the second place.

A Promising Outlook for 2024

Overall, the B2B ecommerce landscape is expected to continue to grow in 2024. Businesses that can adapt to the changing trends and adopt new technologies will be well positioned to succeed in this dynamic market. In summary, the Barometer Analysis of Q4 2023 has unveiled exciting opportunities and a promising outlook for 2024 in the Eurozone. Despite persistent hurdles such as inflation, the economy showed signs of improvement, with expectations of moderate growth and a rebound in foreign demand. As we embark on the journey into 2024, it appears that there are plenty of exciting opportunities and festivities on the horizon.

Key Takeaways

France maintains its leading position as the country with the highest volume of product searches. The preparations for the 2024 Olympic Games in France are impacting search activities. Surge in searches for solar energy equipment driven by the imminent expiration of the electricity tariff shield in 2025.

In conclusion, the Q4 2023 Barometer Analysis provides a roadmap for businesses navigating the dynamic Eurozone markets. From the surge in solar energy to the eclectic mix of product searches, the landscape is evolving, presenting unique opportunities for growth. As we step into 2024, businesses should stay vigilant, leveraging these insights to seize the promising prospects that lie ahead.