Smooth business with intersting peaks

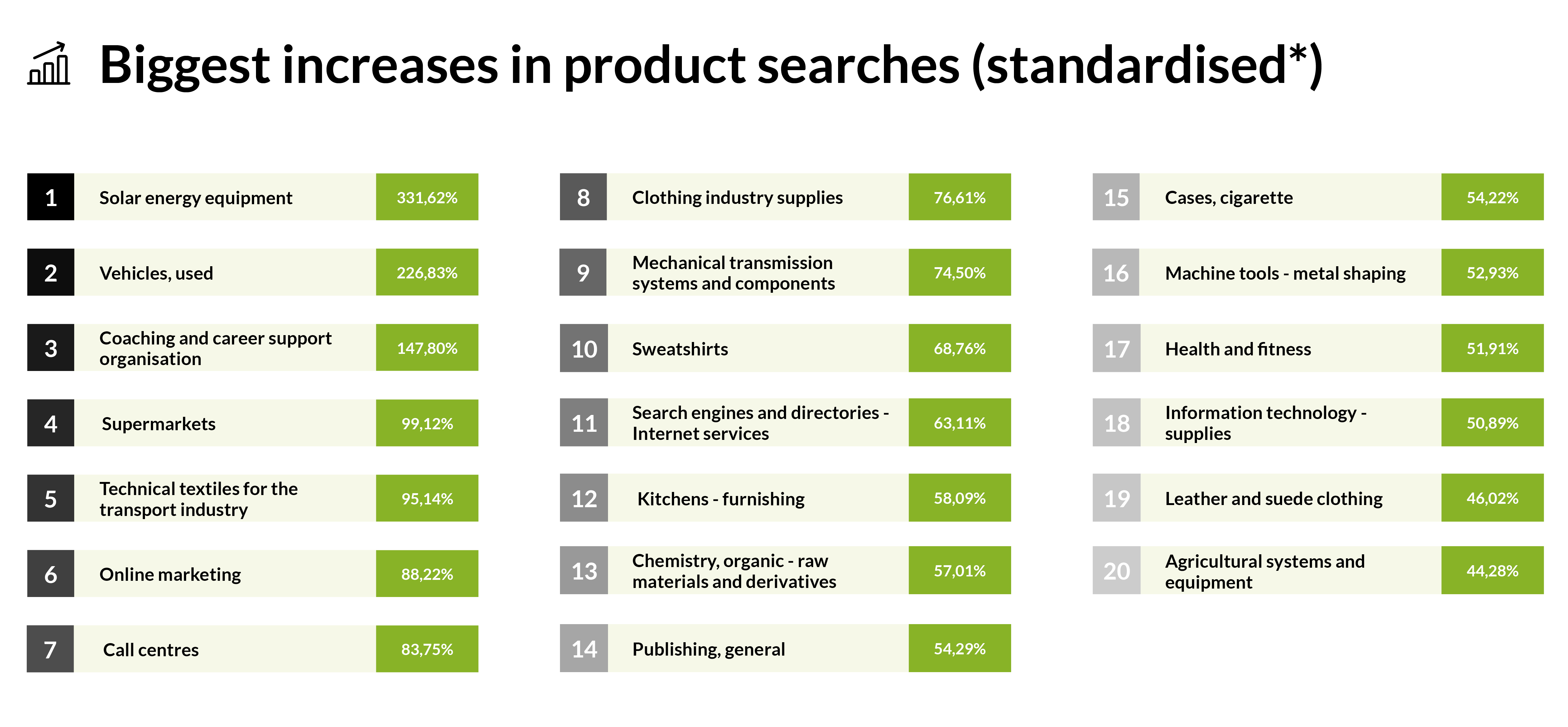

Looking at the 20 products purchasers searched for on europages are categories that serve everyday life – it’s cosmetics, food and clothing, so nothing that points to any special needs right now.

Still very interesting are the increases in product searches of solar energy equipment with a plus of 331,62%, vehicles with a plus of 226,83% and products around coaching and career support organisation with an increase of 147,80%. Maybe one reason for the high demand fos the solar energy equipment is the urge to fulfill the EU solar duty for commercial and public buildings by 2025.

Used car prices are in a downward spiral: The shortage of new cars caused an upward trend in used car prices that lasted for years. A study now shows that prices are falling again - and sharply wich might be the reason for the increase here.

That online marketing, call centers and Search engines and directories – Internet Services are on a plus of more than 60 percent is very interesting and not at least a sign that the B2B world goes more and more digital and maybe enhances service force in order to perform better.

Ecomonic situation in European countries visable in the barometer data

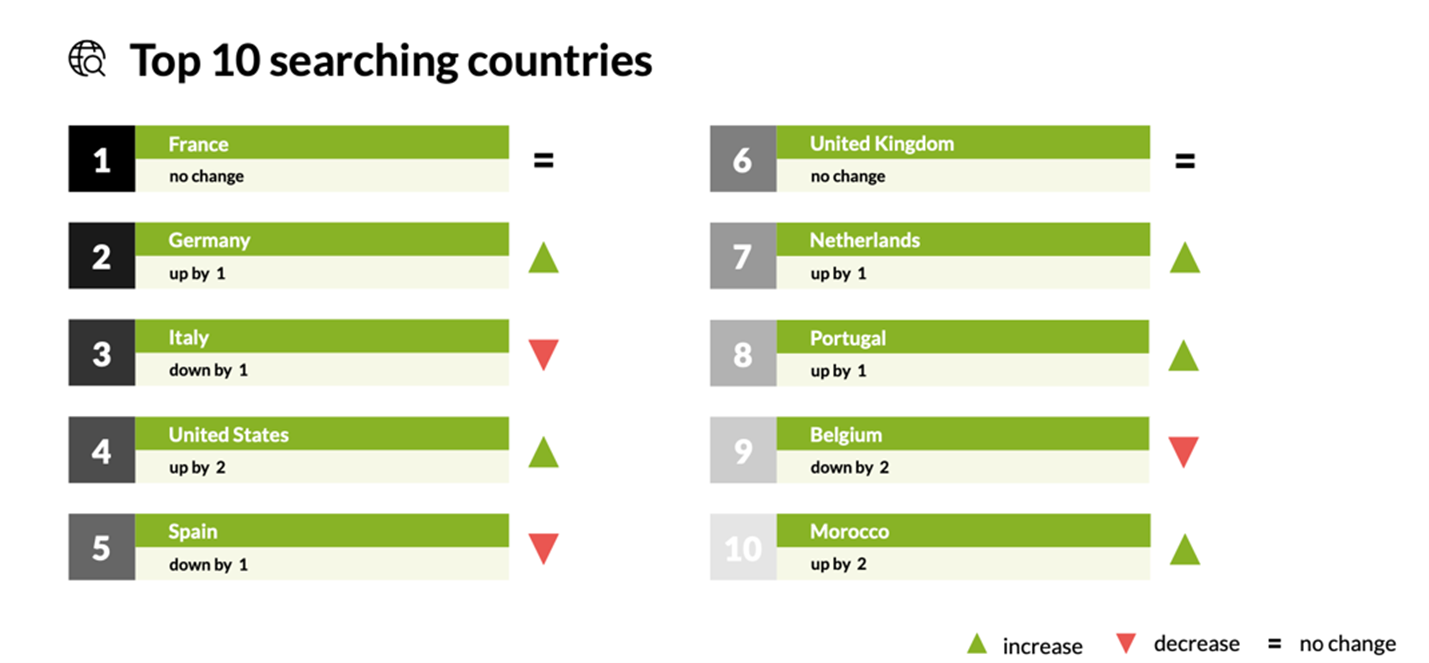

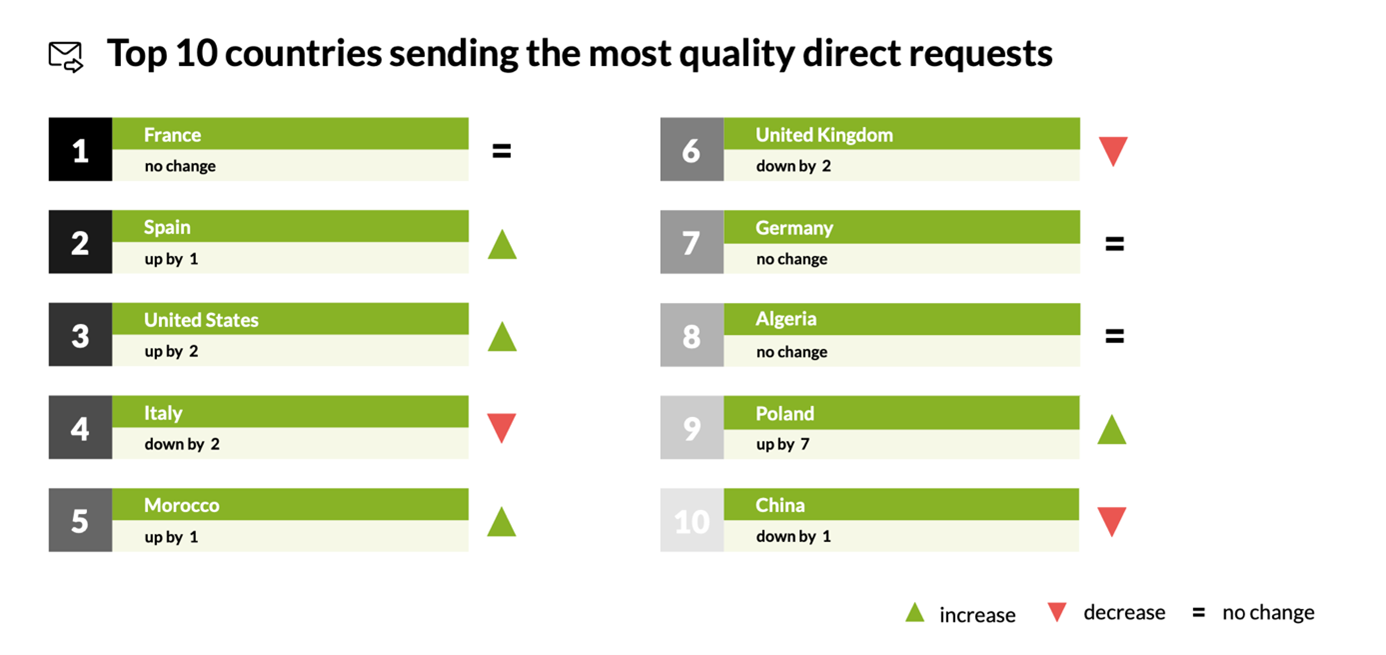

France still on position one in terms of searching behaviour, no change has happened here. Germany and Italy changed positions, so Germany went up one position, Italy went down one position. US had an uplift of two steps, Spain needs to deal with one step down. Watching the whole barometer a slightly alarming sign is that Italy looses in a few categories: High debt, zero growth, rising interest rates: nowhere else in Europe is fiscal policy as delicate as in Italy. So far, the right-wing conservative government is holding its course and acts not very market driven. The fact, that Italy raised position only in being targeted might be that due to the situation prices for purchasers are lower.

Another interesting fact is to notice that Poland gained 7 positions among the top countries sending messages. That might be because there is a big inflation wich potentially means sourcing options for better prices from new suppliers or that the second half of 2023 is expected to be stronger, as real wages and consumer confidence recover with falling inflation, and public investment picks up.